Bank of Mum & Dad Interest Rates

What rate of interest do parents charge their children? We surveyed 2500 parents to find out.

By Sam Davies6/12/20

The ‘Bank of Mum & Dad’ has become, for many millennials, the only route to homeownership. House prices are rising faster than most people can save, and slow wage growth, an acute shortage of homes and extortionately priced smashed avocado on toast is only adding to the problem.

But while the 'Bank of Mum & Dad’ is a popular way for millennials to meet the challenge of strict mortgage criteria and inflated property prices, a new survey suggests that it may not be the most affordable method of borrowing for broke Brits…

We surveyed 2,500 parents in Britain who have loaned their grown-up kids money for a home, and the results were very interest-ing.

Overall, our survey revealed that over a quarter of parents in Britain (25.6%) said they would charge interest on a loan to their precious children. What’s more surprisingly however, is that when looking at that 25.6%, the (un)official Bank of Mum & Dad interest rate in the UK is a staggering 4.3%*. This is much higher than the standard bank interest rates of around 2% or lower - so parents could seriously set to profit from giving their children a foot onto the ladder - especially when you consider that the average parental contribution for homebuyers this year is a huge £18,000, according to Legal & General (L&G).

- 25.6% of parents would charge interest on a home loan to their kids.

- The average ‘Bank of Mum & Dad’ interest rate in the UK is a staggering 4.3% - much higher than high street rates.

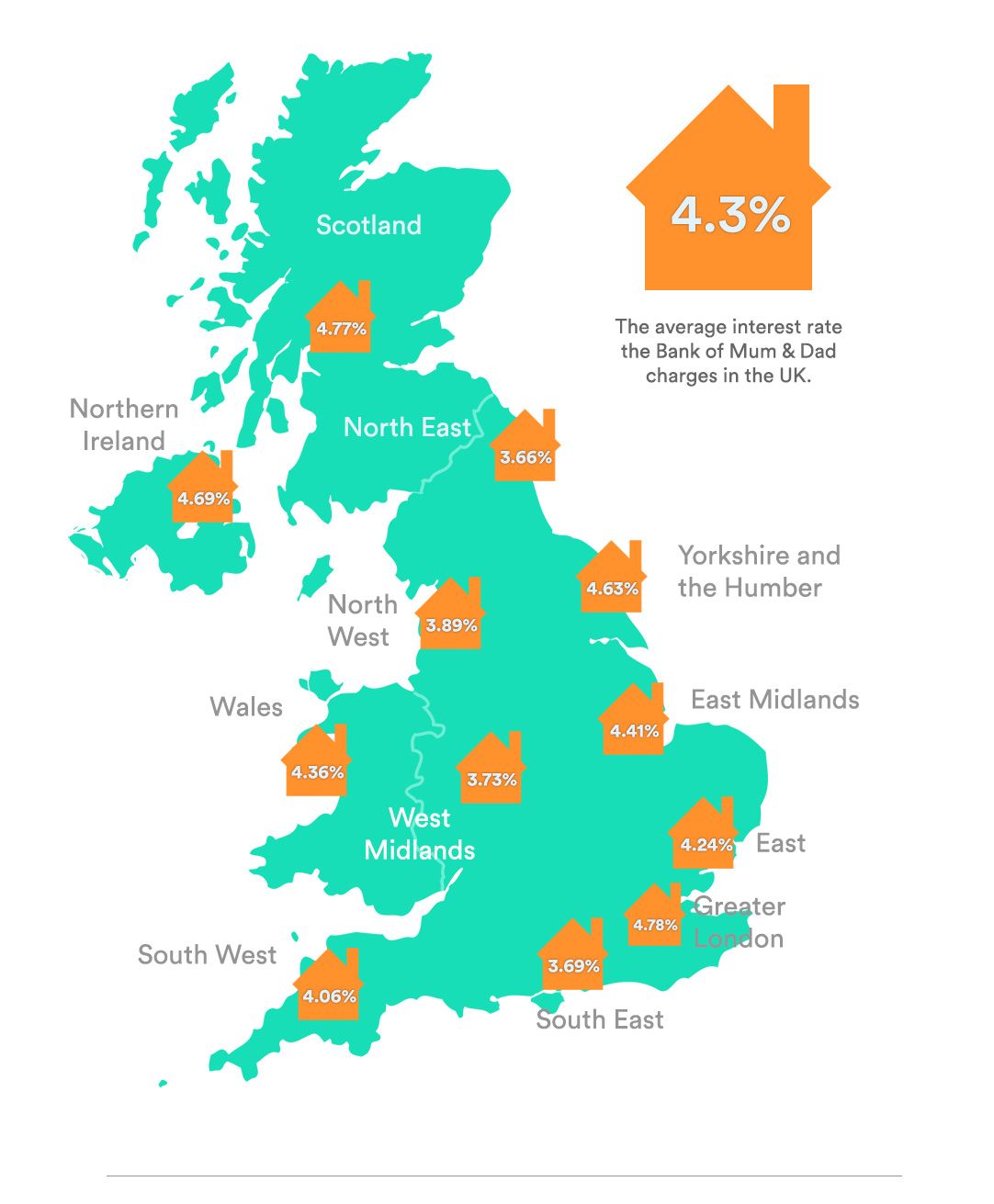

- Mapped: How ‘Bank of Mum & Dad’ interest loans compare across the country.

However, it is also important to remember that most parents would be taking a big risk in loaning money to their kids who don’t qualify for a loan through traditional financing, so many would say it’s only fair they’re covering their backs with a high interest rate. After all, that large sum of money could otherwise be invested elsewhere, so getting a good return on their loan would certainly soften the blow!

We have created the above infographic map which shows how ‘Bank of Mum & Dad’ interest rates compare across the country.

As you can see from the map, the Greater London branch of ‘Bank of Mum & Dad’ charges the highest rates, proposing a whopping 4.78% interest rate to those who want to get a foot on the ladder. It is hopeful homeowners in the capital who are most likely to need the money from their old folks though, given that the average property price in the capital now stands at an eye-watering £619,067**.

On the other end of the affordability scale, the most competitive interest rates in England, (or the most open-handed parents), can be found in the North East, where the average interest rate stands at 3.66%.

On a UK-wide level, our survey revealed that the Scottish Bank of Mum & Dad is the most expensive lender, charging 4.77%. Parents in Northern Ireland come just behind, charging their children high interest rates of 4.69%; the Welsh Bank of Mum & Dad comes in third, with interest rates of 4.36%, and the English Bank of Mum & Dad offers the most competitive interest rates of 4.12%.

Although over a quarter of parents would charge interest on a home loan to their children, interestingly, only half of borrowers (50.4%) said they would prefer to borrow money from their family than a bank. Of course we’d expect this figure to be a lot higher if the Bank of Mum & Dad charges weren’t so high.

That being said, loans between family members can often become messy… According to the survey, 1 in 5, or 20.5% of people who have loaned money to a family member said the relationship has soured as a result.

And there’s bad news if you’re a mature, aspiring homeowner too: 21.3% of respondents said that if you’re over 40, you’re too old to ask for a loan from parents, and an even larger chunk (35.6%) said that they wouldn’t give a loan to their (very adult) child if they were over 50.

Shaan Ahmed, founder at UOWN commented on the results:

“Whilst the bank of Mum and Dad does have some of the highest interest rate payments out there, it may be the only piece of finance that you can get - all the other banks want to know your income, your assets, whereas for the Bank of Mum and Dad just the simple fact you need a helping hand, which they can lend, is enough. (Having the same DNA also helps!)

Millennials today are facing pressures that haven’t been seen before, so it’s no surprise that parents want to help their children onto the property ladder. Ultimately the ‘Bank of Mum & Dad’ is a testament to parents’ generosity and love across the country, but we need to bear in mind that parents face financial pressures just like everyone else, and therefore need a return on their investments. It’s advisable to establish at the outset whether the money being given out is a gift or a loan, and it’s also sensible to reach out for impartial advice that will help your family find the most suitable arrangement.”

*This figure only represents parents who would charge an interest, i.e. not those who provide an interest free-loan.

**According to Rightmove data, checked 29/05/18. http://www.rightmove.co.uk/house-prices-in-London.html

Take a look at our other articles